THE M&A LAWYER BLOG Accessible Mergers and Acquisitions Law

The M&A Lawyer Blog

This blog is dedicated to discussion of U.S. mergers and acquisitions (M&A) transactions, primarily from a legal perspective. It is published by Erik A. Lopez, Sr. Erik is a New York M&A lawyer currently practicing with Jasso Lopez PLLC, a boutique corporate law firm headquartered in Dallas and serving a global client-base.

Anatomy of a Stock Purchase Agreement

Most private M&A transactions are structured as acquisitions of stock, rather than mergers or asset purchases. The principal agreement governing such a transaction is typically a Stock Purchase Agreement (SPA), sometimes styled a Securities Purchase Agreement or simply a Purchase Agreement.

The M&A Lawyer Blog Publishes Forms Database

Mergers & Acquisitions practice relies heavily on the use of forms and precedent. They are the very foundation of what we do. Absent an eidetic memory, even the most accomplished M&A attorneys need precedent consents, agreements, certificates, checklists, filings and other

The New Role of Private Equity Firms

The following is a guest post from Nate Nead, an investment banking Director at Merit Harbor Group, LLC. Nate’s practice focuses on software, technology, energy and manufacturing. He and the Merit Harbor team work with middle-market business owners looking to grow, acquire

M&A Disclosure – Annotated Form 8-K

Public companies that participate in M&A transactions are subject to a myriad of potential disclosure obligations throughout the transaction process. These may arise under applicable stock exchange listing rules, federal securities laws, state fiduciary duty and proxy requirements as well as antitrust

Material Adverse Effect Clauses

Things rarely go according to plan. Earnings are missed. Commercial relationships end. Regulatory approvals don’t materialize. Lawsuits get filed. And disasters happen. Such are the vicissitudes of business. But what happens when they transpire during the gap period between signing and closing an M&A transaction? Most sellers would

Intro to M&A Representations and Warranties

The primary transaction agreement in every M&A deal contains representations and warranties, colloquially referred to as “reps and warranties” or simply “reps,” from each party to the other. These are statements of past, present and sometimes future fact relating to the status,

How to take control of a Board through written consents

On August 19, 2015, the Delaware Court of Chancery issued an opinion in Kerbawy v. McDonnell that addressed how holders of a majority of a company’s shares should take control of a board of directors by executing written consents. The case involved interpretation of Section 228

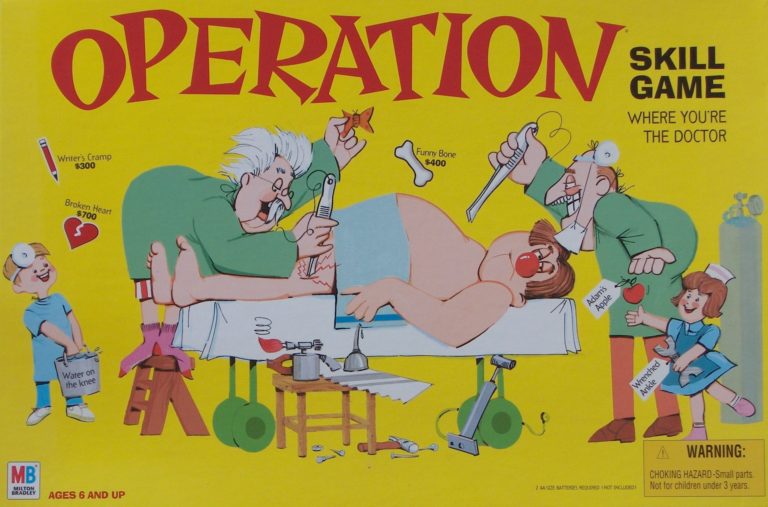

Anatomy of an Asset Purchase Agreement

Like the classic game Operation,® asset purchase transactions require parties to take great care in extracting just what they want. However, successful asset sales require quite a bit more than a pair of tweezers and steady hands. Among other things, they require a

Dole CEO and GC Fraud Liability for Otherwise Proper Going-Private Deal

On August 28, 2015, the Delaware Court of Chancery found the controlling shareholder-CEO and General Counsel of Dole Food Co. Inc. liable to investors for $148 million for fraudulently driving down the company’s share price in anticipation of a going-private transaction.

What does an M&A lawyer do?

An M&A lawyer runs the deal. She is the hub in the hub-and-spoke system of deal parties and their advisers. The M&A lawyer serves as the primary point of contact for the rest of the deal team and has principal responsibility for shepherding the transaction to closing.

FTC Issues Guidance on Antitrust Merger Review

As mentioned in a prior post, if the transaction value for an M&A deal equals or exceeds $92 million (as of the date of this post; the threshold is adjusted annually), an HSR filing may be required with the Premerger Notification

M&A, Corporate and Securities Law Glossary

Today, I published a fairly comprehensive glossary of terms used by M&A, corporate and securities lawyers. Coverage ranges from the “All Holders, Best Price Rule” and “Bear Hug Letters” to “Unocal Standard” and “XBRL.” It includes 550 terms in all. The Glossary is accessible