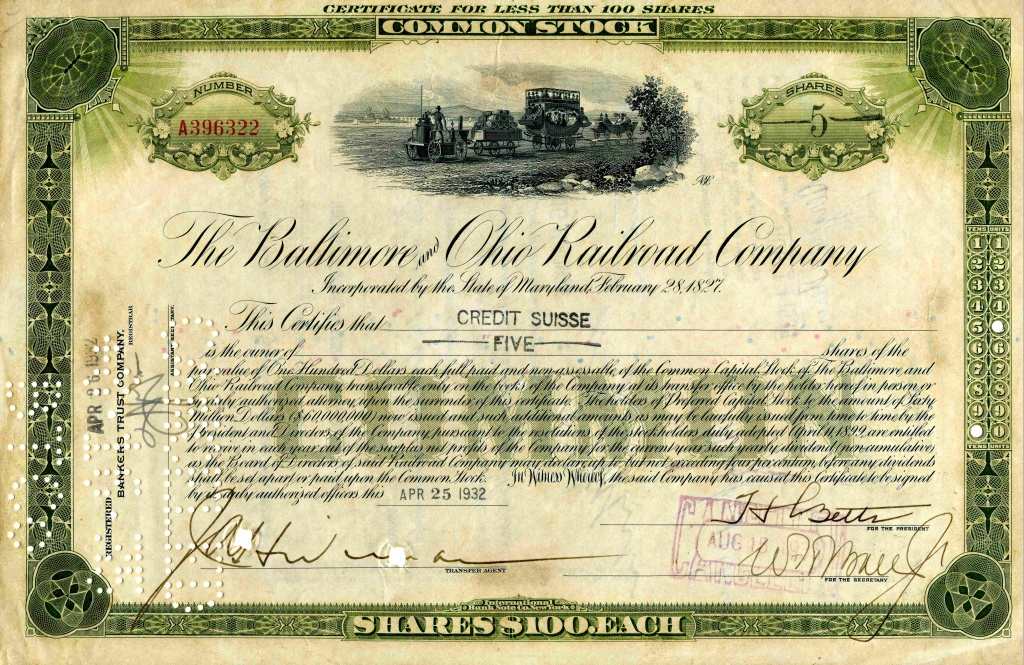

Most private M&A transactions are structured as acquisitions of stock, rather than mergers or asset purchases. The principal agreement governing such a transaction is typically a Stock Purchase Agreement (SPA), sometimes styled a Securities Purchase Agreement or simply a Purchase Agreement. At their most basic level, these agreements provide for the sale of shares in a […]

Anatomy of a Stock Purchase Agreement